Introducing FuturePlan’s National

Cash Balance Research Report

(Prepared March 2023)

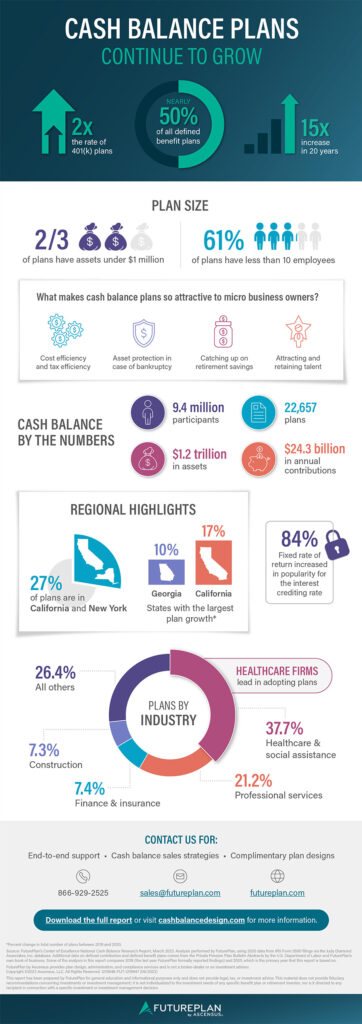

Cash Balance Plan Growth Has Increased by 15-Fold in the Last 20 Years, Making up Almost 50% of all Defined Benefit Plans.

In our 12th annual edition of the Cash Balance Research Report, the experts at FuturePlan by Ascensus analyzed IRS Form 5500 filings for Cash Balance retirement plans (over a 20-year period) along with other data to provide a comprehensive view of this niche market.* Annual growth in new plans, regional trends, plan asset growth, and other statistics are provided as a reference for retirement plan professionals, the media, CPAs, and others interested in learning more about Cash Balance plans.

Report Insights & Highlights:

- The number of new Cash Balance plans doubled from 2019 to 2020, compared to new 401(k) plans.

- Cash Balance plan assets exceed $1.2 trillion nationwide with 9.4 million retirement plan participants.

- Companies with nine or fewer employees make up over 60% of all Cash Balance plans.

- California and New York account for 27% of all new Cash Balance plans, followed closely by Florida and Texas.

- Cash Balance contributions reached $24.3 billion.

*Source: Analysis performed by FuturePlan, using 2020 data from IRS Form 5500 filings via the Judy Diamond Associates, Inc. database. Additional data on defined contribution and defined benefit plans comes from the Private Pension Plan Bulletin Abstracts by the U.S. Department of Labor and FuturePlan’s own book of business. Some of the analysis in this report compares 2018 (the last year FuturePlan formally reported findings) and 2020, which is the primary year that this report is based on.

Infographic: A Snapshot of Key Insights

FuturePlan’s infographic highlights the key trends and insights from the latest research report. This powerful resource analyzes various data sources and visually presents their impact on the growing cash balance market. As advisors, CPAs, and clients become more educated about the benefits of cash balance plans, we expect more opportunities for accelerated retirement wealth for the various small businesses adding these plans.

Click here to view the full-sized infographic.